Shopping Centers Today is the news magazine of the International Council of Shopping Centers (ICSC)

Issue link: https://sct.epubxp.com/i/58695

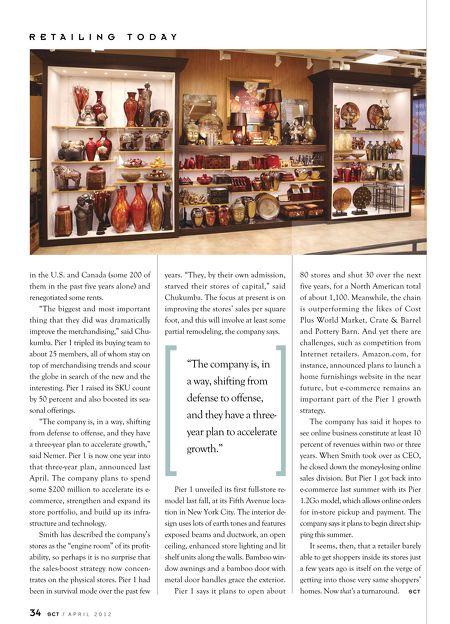

RET AILING TODA Y in the U.S. and Canada (some 200 of them in the past five years alone) and renegotiated some rents. "The biggest and most important thing that they did was dramatically improve the merchandising," said Chu- kumba. Pier 1 tripled its buying team to about 25 members, all of whom stay on top of merchandising trends and scour the globe in search of the new and the interesting. Pier 1 raised its SKU count by 50 percent and also boosted its sea- sonal offerings. "The company is, in a way, shifting from defense to offense, and they have a three-year plan to accelerate growth," said Nemer. Pier 1 is now one year into that three-year plan, announced last April. The company plans to spend some $200 million to accelerate its e- commerce, strengthen and expand its store portfolio, and build up its infra- structure and technology. Smith has described the company's stores as the "engine room" of its profit- ability, so perhaps it is no surprise that the sales-boost strategy now concen- trates on the physical stores. Pier 1 had been in survival mode over the past few 34 SCT / APRIL 2012 years. "They, by their own admission, starved their stores of capital," said Chukumba. The focus at present is on improving the stores' sales per square foot, and this will involve at least some partial remodeling, the company says. "The company is, in a way, shifting from defense to offense, and they have a three- year plan to accelerate growth." Pier 1 unveiled its first full-store re- model last fall, at its Fifth Avenue loca- tion in New York City. The interior de- sign uses lots of earth tones and features exposed beams and ductwork, an open ceiling, enhanced store lighting and lit shelf units along the walls. Bamboo win- dow awnings and a bamboo door with metal door handles grace the exterior. Pier 1 says it plans to open about 80 stores and shut 30 over the next five years, for a North American total of about 1,100. Meanwhile, the chain is outperforming the likes of Cost Plus World Market, Crate & Barrel and Pottery Barn. And yet there are challenges, such as competition from Internet retailers. Amazon.com, for instance, announced plans to launch a home furnishings website in the near future, but e-commerce remains an important part of the Pier 1 growth strategy. The company has said it hopes to see online business constitute at least 10 percent of revenues within two or three years. When Smith took over as CEO, he closed down the money-losing online sales division. But Pier 1 got back into e-commerce last summer with its Pier 1.2Go model, which allows online orders for in-store pickup and payment. The company says it plans to begin direct ship- ping this summer. It seems, then, that a retailer barely able to get shoppers inside its stores just a few years ago is itself on the verge of getting into those very same shoppers' homes. Now that's a turnaround. SCT